#How to Trade Using Cup and Handle Chart Pattern

Explore tagged Tumblr posts

Text

How to Trade Using Cup and Handle Chart Pattern

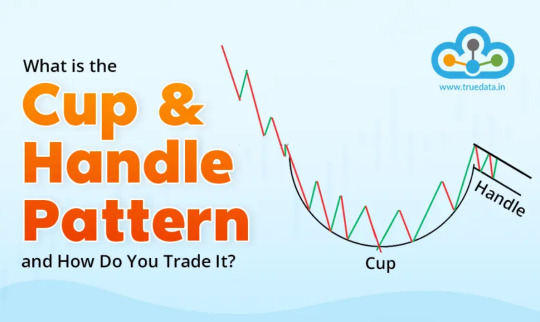

The cup and handle pattern is a decades-old chart pattern that was popularised by William J. O'Neil, a well-known investor and the founder of Investor's Business Daily. He introduced this concept in his book How to Make Money in Stocks, published in the 1980s. O'Neil observed that this pattern often appears in stocks before they make significant upward moves, especially when supported by strong trading volume during the breakout.

This pattern is used to identify potential bullish trends in stocks, commodities, or other financial instruments. The pattern gets its name due to its distinct resemblance to a cup with a handle when viewed on a price chart. The pattern begins with a rounded, U-shaped decline and recovery, forming the ‘cup’. After the cup is formed, there is a smaller, sideways or slightly downward consolidation phase, creating the ‘handle’. This handle typically represents a brief pause before the price breaks out in an upward direction.

Read More: https://www.truedata.in/blog/what-is-cup-and-handle-pattern-and-how-to-trade-it

#What is Cup and Handle Chart Pattern#How to Trade Using Cup and Handle Chart Pattern#Pros and Cons of using the Cup and Handle Pattern for Trading

0 notes

Text

crypto

The cup and handle pattern is one of the most reliable indicators of a bullish market, and this article explains how to spot it and apply it in real trades. It covers the pattern's structure in detail and offers practical advice on using it to predict price movements. If you want to improve your technical analysis skills, check out this article on the inverted cup and handle chart pattern. It’s a powerful tool for any trader.

1 note

·

View note

Text

Unlocking Smart Trading: How SEBI Registered Investment Advisors and Trade Ideas Help You Find the Best Stocks to Swing Trade

Introduction

In today’s dynamic financial markets, retail investors are constantly looking for smarter ways to generate returns. While long-term investing remains a solid strategy, swing trading has emerged as a popular method to profit from short- to medium-term price movements. But successful swing trading requires the right tools, guidance, and research. That’s where SEBI registered investment advisors and reliable Trade Ideas come in.

What Is a SEBI Registered Investment Advisor?

A SEBI registered investment advisor (RIA) is certified and regulated by the Securities and Exchange Board of India. These professionals are authorised to offer personalised investment advice to clients, ensuring compliance with strict regulatory standards. Working with a SEBI-registered advisor ensures that the recommendations you receive are unbiased, transparent, and tailored to your financial goals.

Why Choose a SEBI Registered Investment Advisor?

Trust and Credibility: Backed by SEBI regulations.

Tailored Advice: Investment strategies based on your risk profile.

Transparency: Clear fee structures and unbiased recommendations.

Regulatory Protection: Investors have recourse in case of misconduct.

The Power of Trade Ideas

Trade Ideas refer to carefully selected trading opportunities that are identified based on technical analysis, market trends, and fundamental research. These ideas are often generated by analysts or advisory platforms to help traders identify stocks with strong breakout potential or reversal setups.

What Makes a Trade Idea Valuable?

Data-Driven Insights: Based on market patterns and price action.

Timely Execution: Ideal for short-term trading opportunities.

Backed by Research: Combines technical indicators with macro trends.

Risk-Reward Balance: Highlights optimal entry and exit points.

Finding the Best Stocks to Swing Trade

Swing trading thrives on identifying stocks with strong momentum, volatility, and clear technical signals. The best stocks to swing trade are typically:

In a trending sector or theme (e.g., renewable energy, digital tech).

Showing bullish chart patterns like breakouts, flags, or cup-and-handle formations.

Supported by increasing trading volumes and favorable news sentiment.

Undergoing positive earnings revisions or institutional interest.

With the help of a SEBI registered advisor and expert trade ideas, traders can shortlist such opportunities confidently.

How to Combine Advisory with Trade Ideas

The real advantage comes when you combine both personalised advice and curated stock picks:

Advisory Backing: Get professional validation for trade ideas.

Risk Management: Use advisor strategies to limit losses and protect gains.

Diversification: Advisors help balance your swing trades with long-term holdings.

Consistent Learning: Improve your trading knowledge with expert feedback.

Conclusion

For traders aiming to make informed and confident moves in the market, the combination of a SEBI registered investment advisor, powerful Trade Ideas, and a disciplined swing trading strategy is invaluable. Whether you’re a beginner or an experienced trader, aligning your actions with credible insights and expert guidance will significantly enhance your chances of success.

Start identifying the best stocks to swing trade with the help of trusted advisors and market-tested trade ideas—because smart investing begins with the right partnership.

0 notes

Text

"How to Identify and Trade the Cup and Handle Pattern in Stock Market Technical Analysis"

The Cup and Handle pattern is one of the most popular and reliable chart patterns in technical analysis, often used by traders to identify bullish trends in stocks, forex, and other financial markets. Whether you're a beginner or an experienced trader, understanding this pattern can greatly improve your trading strategy and increase your chances of success. In this post, we'll walk you through how to identify and trade the Cup and Handle pattern, along with tips for effectively incorporating it into your trading plan.

1. What is the Cup and Handle Pattern?

The Cup and Handle pattern is a technical chart formation that resembles the shape of a tea cup. It is a bullish continuation pattern that suggests a stock or asset is likely to continue its upward trend after a brief consolidation. The pattern consists of two main parts:

The Cup: This represents a rounded, U-shaped decline followed by a recovery. It usually takes several weeks or months to form and indicates a period of accumulation or consolidation.

The Handle: After the cup forms, there is a smaller consolidation or pullback that looks like a handle. The handle typically slopes downward, but it should not dip below the halfway point of the cup. This is the final phase before the stock breaks out to the upside.

2. How to Identify the Cup and Handle Pattern

Identifying the Cup and Handle pattern requires attention to detail and patience. Here are the key steps to look for:

a. Forming the Cup

Rounded Decline: The cup should have a smooth, rounded bottom. The decline in price should be gradual, not sharp. Ideally, it should take several weeks or months to form.

Volume Decline: During the decline, volume typically decreases as the price moves lower.

Recovery: After reaching the bottom, the price should begin to recover, forming the right side of the cup. Volume should increase as the price begins to rise, indicating renewed interest from buyers.

b. Forming the Handle

Consolidation: After the cup is complete, the handle forms through a period of consolidation, often lasting from a few days to a few weeks. This consolidation represents a brief pause or "breather" before the next move up.

Volume: Volume should ideally decrease during the formation of the handle and then spike as the breakout occurs.

Handle Position: The handle should not fall below the halfway point of the cup's height. If it does, the pattern may be invalid or less reliable.

c. Breakout Confirmation

Breakout Point: Once the handle has formed and the price breaks above the handle's resistance level, it signals a potential buy point.

Volume Surge: A breakout should be accompanied by an increase in volume. This confirms that the breakout is supported by strong buying interest.

3. Psychology Behind the Cup and Handle Pattern

Understanding the psychology behind the Cup and Handle pattern can help explain why this pattern is so powerful. Here’s how it works:

The Cup Formation: The decline in price and the subsequent recovery reflect a period of accumulation and consolidation. Initially, sellers dominate the market, but as the price reaches the bottom, buying interest starts to increase, leading to a gradual recovery.

The Handle Formation: The brief pullback or consolidation represents a "resting phase." Traders take profits, and the stock consolidates before resuming its upward trend. This consolidation is healthy because it helps the stock gain enough momentum for the next leg up.

The Breakout: When the price breaks above the handle, it represents renewed bullish sentiment and the beginning of the next phase in the stock’s upward journey. Traders who missed the initial run-up may enter the trade at this point.

4. How to Trade the Cup and Handle Pattern

Once you’ve identified the Cup and Handle pattern on a stock chart, it’s time to develop a trading strategy. Here’s a step-by-step guide:

a. Entry Point

Buy Signal: The ideal entry point is when the price breaks above the resistance level formed by the top of the cup (the "rim" of the cup). This breakout signals that the stock is ready to continue its upward movement.

Wait for Volume Confirmation: Before entering the trade, wait for a surge in volume. This confirms that the breakout is legitimate and supported by market participants.

b. Stop Loss

Setting a Stop Loss: A good risk management strategy involves placing a stop loss below the lowest point of the handle. This will protect you in case the price fails to breakout or reverses.

c. Profit Target

Measuring the Price Target: To estimate the potential price movement after the breakout, measure the height of the cup from the bottom to the top and then add that distance to the breakout point. This gives you a rough price target for the next leg up.

d. Risk-to-Reward Ratio

Optimal Risk-to-Reward: The ideal risk-to-reward ratio for a Cup and Handle trade is at least 2:1. For example, if you're risking $1 on the trade (the distance between your entry and stop loss), you should aim to make at least $2 in profit.

5. Common Mistakes to Avoid When Trading the Cup and Handle Pattern

While the Cup and Handle pattern can be highly profitable, there are some common pitfalls to watch out for:

Misinterpreting the Handle: If the handle falls below the midpoint of the cup, it may indicate a weaker pattern or invalid signal.

Not Waiting for Confirmation: Don’t enter a trade until you see the breakout above the handle with an increase in volume. Entering too early can lead to false breakouts.

Ignoring Market Conditions: The Cup and Handle pattern works best in an overall uptrend or strong market conditions. Trying to trade this pattern in a downtrend or choppy market can lead to poor results.

6. Real-World Examples of Cup and Handle Patterns

To further illustrate how the Cup and Handle pattern works, let’s take a look at a few historical examples from well-known stocks:

Example 1: Apple Inc. (AAPL): During the 2009-2010 period, Apple formed a classic Cup and Handle pattern. After breaking above the handle’s resistance, the stock surged by over 40% in the following months.

Example 2: Tesla (TSLA): Tesla’s stock has repeatedly shown Cup and Handle patterns during its bull runs, providing excellent opportunities for traders to enter the market.

7. Conclusion: Mastering the Cup and Handle Pattern

The Cup and Handle pattern is one of the most powerful and well-known chart formations used by traders to spot bullish trends. By learning to identify the pattern correctly, waiting for confirmation, and using proper risk management techniques, you can significantly enhance your trading success. Whether you're trading stocks, forex, or cryptocurrencies, incorporating the Cup and Handle pattern into your technical analysis toolkit can give you a significant edge in the market.

0 notes

Text

Decoding Crypto Trading Patterns: A Guide for Smarter Investments

Crypto trading patterns are crucial tools for navigating the volatile cryptocurrency market. These visual representations of price movements help traders predict future trends and make informed decisions. Leveraging patterns through technical analysis can provide a structured approach to trading, minimizing emotional decisions and maximizing potential profits. This guide will explore key trading patterns, tools, and strategies to help you decode market movements and improve your investment decisions.

Why Crypto Trading Patterns Matter

Crypto trading patterns are essential for understanding market behavior and making smarter trading choices. They help predict whether the market is entering a bullish or bearish trend, aiding in well-timed entries and exits. Patterns also create a disciplined approach to trading, reducing impulsive actions and emotional decision-making. Additionally, they work across trading styles—be it day trading, swing trading, or long-term investing—making them versatile tools for every trader.

Key Crypto Trading Patterns to Know

Understanding specific trading patterns is vital for success:

Candlestick Patterns:

Bullish Patterns:Hammer, Morning Star.

Bearish Patterns: Shooting Star, Evening Star.

Chart Patterns:

Continuation Patterns:Flags, Pennants, and Triangles, which indicate ongoing trends.

Reversal Patterns:Head and Shoulders, Double Top/Bottom, signaling trend reversals.

Breakout Patterns: Identify potential explosive price movements. Visual aids, such as graphics or examples, can help traders quickly recognize these patterns during analysis.

Understanding Support and Resistance Levels

Support and resistance levels are critical markers in technical analysis. Support represents price levels where demand increases, preventing further declines, while resistance marks points where selling pressure intensifies, halting upward movements. These levels are key in validating trading patterns, as they highlight areas for potential trend reversals or continuations, helping traders decide when to enter or exit positions.

Tools for Analyzing Trading Patterns Modern tools make analyzing trading patterns more efficient:

Charting Platforms: Platforms like TradingView, Binance, and PrimeTrader provide detailed visuals and pattern-recognition tools.

Indicators: Tools like RSI, MACD, and Fibonacci retracements confirm patterns and signal strength.

Automation:AI-driven tools identify patterns in real-time and execute trades, offering speed and accuracy. Using these tools helps traders refine their analysis and execute strategies with confidence.

Applying Trading Patterns in Different Strategies Trading patterns adapt to various trading strategies:

Day Trading:Identify intraday patterns like flags or triangles for quick profits.

Swing Trading:Use medium-term patterns for trades lasting several days.

Scalping:Rely on micro patterns for rapid, small-margin trades.

Long-Term Investing:Look for broader patterns, such as the cup and handle, to predict sustained trends. Each strategy benefits from incorporating patterns, tailoring them to specific market behaviors and timeframes.

Common Mistakes to Avoid When Using Patterns While trading patterns are powerful, common pitfalls can hinder success:

Overtrading:Acting on incomplete or weakly confirmed patterns can lead to losses.

Ignoring Volume:Trading volume is a critical factor that validates patterns.

Neglecting Risk Management:Always use stop-loss orders and proper position sizing.

Confirmation Bias:Avoid interpreting patterns to fit preconceived expectations. By steering clear of these mistakes, traders can improve accuracy and profitability.

Advanced Pattern Recognition with AI and Automation

AI and automation are revolutionizing how traders use patterns. Advanced tools can analyze charts and detect patterns in real-time, providing instant insights. Platforms like PrimeTrader incorporate AI-driven features, automating pattern recognition and trade execution. This technology reduces errors and ensures swift responses to market changes, giving traders an edge in a fast-paced environment.

The Role of Trading Psychology in Using Patterns

Trading success depends as much on psychology as it does on technical analysis. Discipline, patience, and objectivity are crucial for interpreting and applying patterns effectively. Sticking to a strategy during volatile market conditions and mastering emotions like fear or greed can significantly improve decision-making. A calm and focused mindset ensures better execution and long-term success.

Conclusion

Crypto trading patterns are indispensable tools for navigating the complexities of the cryptocurrency market. By understanding and applying these patterns, traders can make smarter, more informed decisions and reduce risks. Whether you're day trading, swing trading, or investing long-term, incorporating pattern analysis into your strategy can boost your success.

0 notes

Text

Bullish Buffet: Knowing When to Feast on Gains in Trading with MintCFD

In the world of online trading, the “Bullish Buffet” approach is about feasting on gains when market conditions align just right. This mindset focuses on recognizing bullish signals and making the most of market opportunities without letting excitement lead to reckless decisions. MintCFD, with its powerful tools and data-driven features, offers traders a smart way to adopt this approach, helping them maximize gains while keeping uncertainty in check.

The “Bullish Buffet” Mindset

The Bullish Buffet isn’t just about grabbing profits — it’s about identifying the right moments to enter the market, based on solid analysis. On the MintCFD trading app, traders can leverage a variety of tools, like real-time data and types of trading chart patterns, to spot market trends and ensure that their decisions are informed and precise. Recognizing a bull market, which refers to a steady rise in asset prices, is critical. In these scenarios, a Bullish Buffet investor aims to “feast” on the gains that come from upward trends while remaining vigilant.

Identifying Bullish Signals on the MintCFD Platform

A bull market often brings strong momentum, which can be tracked using MintCFD’s analytical tools. With access to chart patterns like the Rising Wedge or Cup and Handle, traders can spot signs of a sustained uptrend. The MintCFD app also offers alerts and indicators to catch these moments early. For example, a breakout from a resistance level may signal a potential upward trend, giving a Bullish Buffet trader a clear opportunity to enter the market.

How to Implement the Bullish Buffett Strategy with MintCFD

Focus on Market Indicators: Using tools like moving averages, MintCFD traders can spot bullish trends early. By observing patterns and comparing them to historical data, traders can build a case for their decisions rather than relying solely on market sentiment.

Set Clear Profit Goals: The Bullish Buffet approach isn’t about greed; it’s about maximizing gains while the market is favorable. Setting clear profit targets in the CFD trading app helps traders lock in gains without holding on too long, reducing the likelihood of reversal losses.

Manage Hazards with Stop-Loss Orders: Even in a bull market, fluctuations can happen. MintCFD’s stop-loss feature allows traders to manage risk by automatically selling if prices fall below a set level. This way, traders can capitalize on gains without risking too much if the market turns.

Why MintCFD is Perfect for the Bullish Buffet Strategy

MintCFD provides a streamlined, data-focused platform for investors looking to make informed decisions. The app’s comprehensive set of trading tools allows traders to view trends, make quick decisions, and keep their focus on long-term gains. With features like instant market alerts, access to diverse chart patterns, and flexible trading options, MintCFD is a great fit for traders following the Bullish Buffet approach.

In Conclusion

The Bullish Buffet is about being prepared to “feast” on gains when the market is upswing while protecting profits from sudden drops. MintCFD’s advanced features make it easy to apply this strategy, helping traders make confident, timely decisions. MintCFD users can successfully navigate bullish markets and fully embrace the Bullish Buffet approach by focusing on real-time data and smart hazard management.

1 note

·

View note

Text

🚀 Complete Guide to Technical Analysis: How Traders Read Charts Like Pros

Technical analysis isn’t just about looking at squiggly lines and colors on charts. It’s about decoding market psychology, price behavior, and decision-making—all through historical price data. For traders across the globe, including in India's NSE and BSE, technical analysis is a cornerstone of strategy.

Whether you're day trading Nifty 50 or analyzing long-term opportunities in Reliance or Infosys, this guide will equip you with the complete technical toolkit to trade like a pro.

🎯 What Exactly Is Technical Analysis (And Why Do Traders Trust It?)

Technical analysis is the study of past market data—primarily price and volume—to forecast future price movements. Unlike fundamental analysis, which evaluates a company’s intrinsic value through financials, TA assumes everything is already priced in.

📚 Originating from the ideas of Charles Dow (yes, the Dow Theory guy), it laid the foundation for tools used by millions of traders worldwide today. Even in India, market veterans like Rakesh Jhunjhunwala and Radhakishan Damani have acknowledged the importance of timing—something TA aims to master.

✅ Traders in the Indian stock market use technical analysis on stocks like Tata Steel, HDFC Bank, and Infosys, particularly for intraday and swing trades. Tools like Strike Money, TradingView, and MetaTrader provide advanced charting features that simplify this process.

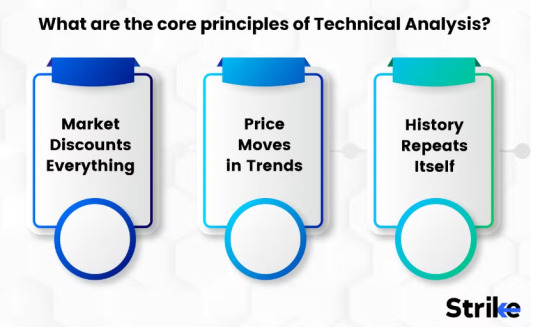

🧠 The Mindset Behind Technical Analysis: 3 Core Principles

🔁 History Repeats Itself Markets are driven by crowd psychology. Patterns that worked in 2010 often work in 2025. For example, Wipro's double bottom in 2020 triggered a breakout that analysts had seen before.

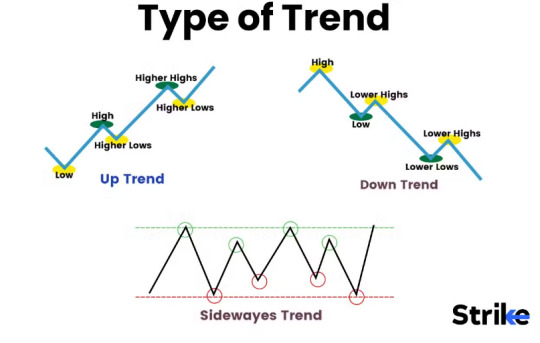

📉 Price Discounts Everything Whether it’s an RBI rate hike or company earnings, technical analysts believe all news is already reflected in price movements.

📈 Trends Are Your Friends A stock in motion stays in motion—until proven otherwise. Traders follow trends rather than fight them. For example, Adani Enterprises’ uptrend in early 2021 saw record participation because of trend momentum.

🖼️ Types of Charts: Reading Candles, Lines & Bars Like a Pro

Charts are the visual language of the markets. If you're staring at numbers, you're doing it wrong.

🕯️ Candlestick Charts are the favorite among Indian traders. Originating from 18th-century Japanese rice traders, these charts reveal psychology behind price moves. A bullish engulfing pattern spotted on TCS in April 2023 led to a 12% rally in a week.

📊 Line Charts show closing prices only. Great for spotting long-term trends.

🪵 Bar Charts give similar data as candlesticks but are harder to interpret visually.

On platforms like Strike Money, you can switch between chart types with a click and compare multiple stock patterns in real time.

📍 Chart Patterns That Consistently Predict Breakouts

Patterns are more than just shapes—they are footprints of market participants.

👤 Head and Shoulders: Seen on Infosys before its correction in late 2022. It signals a trend reversal. 🏆 Cup and Handle: Seen on Maruti Suzuki in 2021 before a multi-month uptrend. 🔺 Ascending Triangles: These breakout setups are powerful in bull markets. Hindalco displayed one in 2020 before it shot up over 80% in 6 months.

Patterns are not guarantees—but when combined with volume analysis, they offer strong probability setups.

📊 Indicators That Add Muscle to Your Analysis

Indicators give you confirmation, timing, and momentum. The best traders don’t use dozens—they master a few.

📉 RSI (Relative Strength Index) tells you when a stock is overbought or oversold. For example, Nifty 50’s RSI dropped below 30 in March 2020, signaling panic—and a rebound followed.

⚡ MACD (Moving Average Convergence Divergence) shows trend momentum. A bullish MACD crossover on ICICI Bank in 2021 led to a 15% rise.

📉 Bollinger Bands, created by John Bollinger, are powerful for spotting volatility squeeze setups. Stocks like Zomato often show these during consolidation.

📐 Fibonacci Retracement, inspired by Leonardo Fibonacci’s sequence, helps identify potential pullback levels. For instance, SBI retraced to 61.8% in mid-2022 before continuing its rally.

With Strike Money, you can layer these indicators onto charts, analyze confluence, and even run backtesting for free.

💡 How Indian Traders Use Technical Strategies: Intraday to Swing

🎯 Intraday Trading: Traders look for 5-minute breakouts on stocks like Tata Motors or Bank Nifty. Strategies often involve VWAP, RSI, and price action.

🔄 Swing Trading: Timeframe shifts to daily or weekly. Stocks like L&T or Sun Pharma often exhibit clean trends perfect for swing setups.

💥 Breakout Trading: Stocks like Paytm breaking long resistance zones often reward breakout traders with strong momentum.

🔁 Mean Reversion: When stocks like HDFC Life drop below the lower Bollinger Band with RSI < 30, contrarian trades are triggered.

A key part of strategy is risk management—using stop losses and risk-reward ratios. A common rule: never risk more than 2% per trade.

🛠️ Charting Tools Every Indian Trader Should Know

📍 Strike Money: A rising star in the Indian charting space, it offers intuitive charting, live data, and tools like Fibonacci, moving averages, and volume overlays—perfect for both beginners and pros.

📍 TradingView: Popular worldwide, supports scripts like Pine editor and advanced backtesting.

Having the right tools isn’t optional—it’s essential. With mobile-first platforms like Strike Money, analysis happens in real-time, anywhere.

❌ Common Mistakes That Ruin Technical Trades

🚫 Using too many indicators: Analysis paralysis is real. 5 indicators telling different stories leads to confusion.

🚫 Ignoring volume: Price moves without volume = fakeouts. Always confirm with volume, like in Reliance’s breakout in 2020—it had massive volume spikes.

🚫 No backtesting: If you haven't tested a strategy on historical data, don’t risk real capital.

🚫 Overtrading: Many intraday traders in India fall into the trap of chasing every candle. Patience > FOMO.

Research by SEBI in 2023 showed that 89% of intraday traders lost money—often due to poor strategy and lack of discipline.

🧪 Can You Trust Technical Analysis? Let’s Talk Research & Reality

A 2014 study by the Journal of Financial Markets showed that technical trading rules can generate above-average returns in emerging markets—including India. However, effectiveness drops if widely known strategies are overused.

In India, a 2021 report by Zerodha revealed that traders who combined technical analysis with position sizing and journaling had 3x better performance than those trading on tips and news alone.

So yes—technical analysis works, if applied with consistency and risk control.

🧭 Technical vs Fundamental Analysis: Should You Choose One?

📈 Technical = Timing 📊 Fundamental = Value

Let’s say you're bullish on Tata Power due to renewable energy reforms. That’s a fundamental bet. But when to enter? Technical analysis shows a breakout in volume and RSI divergence—your green light.

In volatile sectors like pharma and fintech, many investors use both approaches. Combining the ‘why’ of fundamentals with the ‘when’ of technicals gives a holistic trading edge.

🙋♂️ FAQs About Technical Analysis

🤔 Can TA predict the future? No—but it gives you probabilities, not certainties. It's like a weather forecast.

⌛ How long does it take to learn? 3–6 months of daily practice using tools like Strike Money can build a solid foundation.

💰 Is it good for crypto or forex? Yes. BTC, ETH, USD-INR—all follow patterns and react to indicators.

📉 Is TA just for short-term trading? Not at all. Long-term investors use it to spot better entry points too.

🎬 Final Thoughts: Is Technical Analysis Right for You?

Technical analysis isn't magic. It's a tool. A very powerful one—when used with discipline, strategy, and backtesting. Whether you’re trading TCS, Bank Nifty, or Zomato, TA gives you an edge in a game that’s all about timing and precision.

If you want to cut through the noise, make informed trades, and build confidence, learning technical analysis is a no-brainer.

✨ Start with one indicator, one pattern. Use tools like Strike Money to chart and journal your trades. Don’t chase perfection—chase progress.

0 notes

Text

Understanding the Core Characteristics of Stock Charts

Stock charts are essential tools for traders and investors, providing a visual representation of a stock's price movement over time. These charts are not just random lines on a graph; they are a reflection of the stock's performance and are influenced by market sentiment, news, and economic events. To effectively utilize stock charts, one must understand their core characteristics and how to interpret them.

Timeframes

Timeframes are a fundamental aspect of stock charts, allowing traders to view price movements over different periods. Whether it's minutes, hours, days, months, or years, each timeframe can provide unique insights into the stock's behaviour. Short-term timeframes might be used for day trading, while long-term timeframes can be beneficial for investors looking to hold positions for longer periods.

Price and Volume

The vertical axis of a stock chart typically represents the stock price, while the horizontal axis represents time. Beneath the price chart, you'll often find the volume represented, which shows the number of shares traded during a given period. Volume is a significant indicator as it can confirm trends; an upward price movement with increasing volume can indicate strength in the trend.

Chart Types

There are various types of stock charts, but the most common ones include line charts, bar charts, and candlestick charts. Line charts are straightforward, tracing a stock's closing prices over time. Bar and candlestick charts provide more detailed information, showing opening, closing, and high, and low prices within a specific timeframe.

Trend lines and Patterns

Trend lines are drawn to connect price points and help identify the direction of the stock's price movement. Patterns, such as triangles, head and shoulders, or cup and handle, can signal potential reversals or continuations in price trends. Recognizing these patterns can be crucial for making informed trading decisions.

Technical Indicators

Technical indicators are mathematical calculations based on the price, volume, or open interest of security. Common indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators can help predict future price movements and are essential for technical analysis.

Chart Patterns

Chart patterns, like technical indicators, are used to predict future price movements. Patterns can be as simple as a support or resistance level, or as complex as a double top or bottom. Understanding these patterns can provide a strategic advantage in identifying entry and exit points.

Price Divergence

Price divergence occurs when the price of a stock is moving in the opposite direction of a technical indicator, such as the RSI or MACD. This can be a signal that the current trend is weakening and may reverse soon.

Fundamentals

While stock charts are primarily used for technical analysis, it's important not to overlook the fundamentals of a company. Earnings, dividends, and other financial data can also impact a stock's price and should be considered when analysing charts.

In summary, stock charts serve as profound insights into the market's essence, capturing the amalgamation of actions and emotions from all participants. Comprehending the intrinsic nature of stock charts empowers traders and investors to make judicious decisions, grounded in visual depictions of price shifts and trends. For those eager to delve further into stock chart analysis, platforms like Liberated Stock Trader provide extensive resources and courses to refine your expertise. Always bear in mind, that the essence of prosperous trading lies in perpetual learning and adeptness in navigating the evolving market landscape.

0 notes

Text

Master the Market with These Top Chart Patterns for Trading

Trading isn’t just about numbers; it’s about mastering the art and science of the financial markets. At Funded Traders Global, we’re here to help you do just that, and it all starts with understanding the power of Top Chart Patterns for Trading.

In our latest blog, we’ve unraveled the secrets of chart patterns, revealing how they can be your compass in the complex world of trading. We have also uploaded a detailed blog on Chart Patterns. You can check that for more detailed learning about Chart Patterns.

So let’s first understand what is chart pattern…

Understanding Chart Patterns

Basics of Technical Analysis

Before diving into chart patterns, it’s essential to understand the fundamentals of technical analysis. This approach relies on historical price data and volume to predict future price movements. By studying charts, you can spot recurring patterns that indicate potential buying or selling opportunities.

Role of Price Action

Price action is at the heart of chart patterns. It represents the collective psychology of market participants. Chart patterns are formed as a result of price action, and understanding this action is crucial for interpreting patterns accurately.

Benefits of Recognizing

Recognizing chart patterns has numerous advantages. It can improve your entry and exit points, enhance risk management, and increase the probability of profitable trades. Furthermore, chart patterns provide a visual representation of market sentiment, making it easier to spot trends and reversal

Common Chart Patterns

Head and Shoulders

The head and shoulders pattern is a classic reversal pattern. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). This pattern signals a potential trend reversal from bullish to bearish.

Double Top and Double Bottom

Double top and double bottom patterns are also reversal patterns. They indicate a potential shift in market sentiment. Double tops suggest a bearish reversal, while double bottoms imply a bullish reversal.

Bullish and Bearish Flags

Flags are continuation patterns. They represent brief pauses in a prevailing trend before resuming in the same direction. A bullish flag forms during an uptrend and is a bullish continuation signal, while a bearish flag forms during a downtrend and is a bearish continuation signal.

Cup and Handle

The cup and handle pattern resembles the shape of a teacup. It is a bullish continuation pattern that indicates a potential upward trend continuation.

Symmetrical, Ascending, and Descending Triangles

These triangle patterns signify potential breakouts. Symmetrical triangles suggest uncertainty, ascending triangles indicate bullish sentiment (Expectation of price rise), and descending triangles indicate bearish sentiment (Expectation of price decline).

Funded Traders Global can provide the capital and resources you need to start trading with confidence. They offer funding programs and support to traders looking to grow their portfolios.

Advanced Chart Pattern

Pennants

Pennants are short-term consolidation patterns that often precede sharp price movements. They resemble small symmetrical triangles and can be bullish or bearish, depending on the preceding trend.

Wedges

Wedges are similar to triangles but are typically sloped. Rising wedges are bearish while falling wedges are bullish.

Gaps

Gaps occur when there is a significant difference between the closing price of one candlestick and the opening price of the next. They often indicate strong price momentum and can be used to identify potential support or resistance levels.

Harmonic Patterns

Harmonic patterns are complex but highly accurate. They include patterns like the Gartley, Butterfly, and Bat patterns, which are based on Fibonacci ratios and symmetry.

Practical Tips for Chart Patterns Trading

To successfully trade using chart patterns, you should:

Implement robust risk management strategies.

Identify precise entry and exit points.

Choose appropriate timeframes for your trading style.

Combine chart patterns with other technical indicators for confirmation.

Conclusion

Are you ready to take your trading to the next level? At Funded Traders Global, we’re committed to helping you become a more skilled and successful trader.

Start your journey by mastering Top Chart Patterns for Trading—a fundamental tool in the trader’s toolkit. Recognize patterns, make informed decisions, and manage risk with confidence.

Join Us on Discord or Contact Us directly. Don’t wait—seize the opportunity to transform your trading career with us!

1 note

·

View note

Text

Trading Strategies Uncovered as Maverick Protocol ($MAV) Displays 'Cup and Handle' Pattern

CryptoBusy, a notable participant in the ever-volatile crypto market, recently exhibited prowess in navigating the tumultuous terrain. Their adept trading strategies, specifically leveraging the 'Cup and Handle' pattern in Maverick Protocol ($MAV) trades, yielded impressive returns, shedding light on the dynamic dynamics of the cryptocurrency market.

In a comprehensive analysis, CryptoBusy shared insights into their success with both short and long-term trading strategies for $MAV. The short trade, strategically capitalizing on rejection at a robust resistance level, resulted in a remarkable +64.31% Return on Investment (ROI). Initiating the trade at 0.5523 USDT and closing at 0.5301 USDT, CryptoBusy's precise entry and exit points underscore the effectiveness of their trading strategy.

Equally noteworthy was their long trade strategy, where patience played a key role. Waiting for a bounce from the 61.8% Fibonacci retracement level, this approach yielded a +37.43% ROI. The trade commenced at 0.6052 USDT and concluded at 0.6605 USDT. The chart annotations for MAV/USDT provided a visual narrative, emphasizing specific entry and exit points while clearly depicting profit and loss zones.

The chart's spotlight on the 'Cup and Handle' formation offered valuable insights into the market's behavioral patterns. As a bullish indicator, this formation hinted at an impending uptrend, providing traders with a strategic advantage.

CryptoBusy's success story comes with a crucial reminder about the significance of project fundamentals. While their trades demonstrated profitability, CryptoBusy emphasizes the need for diligence, acknowledging that not all trades guarantee success. Their holistic approach involves identifying resistance and support levels, coupled with waiting for confirmations using tools like MACD and RSI.

In the broader market context, Maverick Protocol's price stood at $0.685226, marking a commendable 14.06% increase over the last 24 hours. This triumph in $MAV trades serves as a testament to the ever-evolving and often unpredictable nature of the cryptocurrency market, showcasing how adept traders can navigate complexities and capitalize on patterns like the 'cup and handle' for profitable outcomes.

#CryptoBusy#$MAV trades#ROI#CryptoBusy analysis#Maverick Protocol#cryptocurrency market dynamics#MAV/USDT price chart#Cryptotale

0 notes

Text

in a sky full of stars, i think i saw you

(steo sailor au)

---

The door to the pub opens, permitting a rush of cold air inside the establishment. The door closes behind a band of a dozen sailors, making a port for the evening. They huddle in an empty table at the center, except for one. This man has his eyes set to the bar, and so his booted feet carry him there. He slides into a long stool, leaning on the counter with a comely smile.

"A pint, if you will," he tells the barman behind the counter. "And none of the deep frowns on that beautiful face, please."

The barman arches an eyebrow, unimpressed. "Is that how you sailors attempt to get laid?" he replies as he prepares the drink.

"Captain!" One of the newcomers yells from their table, grinning from ear to ear. "What about our drinks? Before you get too busy slithering inside of Stiles's pants to pay us any notice."

"Shut your mouth, Josh," Stiles snaps without turning back as he fills mug after mug of beer. "And get the drinks yourself."

The rest of the table erupts in laughter, and patrons from the other tables also contribute to the ridicule. Josh rolls his eyes and stands to make for the bar.

Stiles slams the last of the mugs just when Josh reaches them, shaking his head at his captain, who only gives him an amused shrug. Josh turns to Stiles, "I see your pants are in a twist," his lips tug in a smirk, side-eyeing the captain. "Well, don't kill Theo too much. We still have to set sail early the next morning."

Stiles's only response is to glare.

When the rest of Theo's crew are howling and exchanging sailor's tales of adventures and conquests over their drinks, Theo faces forward and gives Stiles his full attention. The barman is still scowling as he slides Theo's pint in front of him, sloshing the contents in his careless handling. He wipes the spill before giving Theo his back and pretending to be busy cleaning cups.

When it's past a minute without further acknowledgment of his presence, Theo sighs. "Stiles,"

The latter remains unfailingly stubborn. Stiles promptly moves to organize the bottles that are already in stellar position on the shelves.

"I have brought books from when we traded in The Caribbean," Theo tells him. The statement procures the desired effect as Stiles noticeably pauses. "I thought you might like to collect them."

After a short moment of consideration, Stiles turns to Theo, tight expression unchanging but mixed with interest this time. His forehead creases a little more when Theo dares to smile at him. "Will we be disturbed-" he glances to Theo's crew as he says this. "as I peruse through these books?"

Theo laughs shortly, "They know better than that."

Stiles doesn't answer immediately. Theo is content at addressing the latter with an equal stare while he considers the offer. Finally, Stiles puts down the cloth in his hand and calls for his father's younger ward, Liam, to take the bar while he's gone.

"How long will you be gone?" Liam asks, sending suspicious glances in Theo's direction.

Stiles hesitates, thinking about his reply to the question. It seems he isn't sure himself. But he squares his shoulder, lifts his chin, and says, "I won't be back until the morning."

Liam blinks, but Stiles doesn't allow him time to ask more questions as he walks ahead of Theo to the door. Theo is a little surprised as well, but he follows, ignoring the loud wolf-whistles of his crew.

•••

Over two hours pass, Stiles lays on his stomach on Theo's bed, a thick sheet covering him modestly from the waist down. As captain, Theo is privileged with a private quarter that has been infinitely useful since their affair began. He rests his head on his crossed arms, breathing in the satisfaction he has craved for months, while Theo runs his calloused fingers on the expanse of his back.

Stiles squints his eyes open to take a look at the enraptured concentration on Theo's features. "You're charting my back again,"

Theo's two fingers trace a pattern on his skin, "Your freckles form constellations of stars."

Stiles snorts on the pillow, "You've only been looking at a map of stars for too long that you see patterns everywhere."

"Not everywhere," Theo responds, voice soft. "Just on you. I've noticed since the first time," he admits. "I just never had time to outline them to you. You always leave before I can."

The silence that follows is laden with meaning. And even though Stiles has wanted to have this conversation for a while now, he is always unsure. Tonight is the first time they speak about the ambiguity of their involvement. Stiles swallows, "You have all night now."

"Hm," Theo hums, moving from his side to climb on top of Stiles, caging the latter's hips with his thicker thighs and settling his weight over the small of Stiles's back. Theo makes sure he isn't crushing the other man, as his fingers point to a place just below Stiles's left shoulder blade. "Segin, Ruchbah, Navi, Schedar, Caph," he recites, then traces a zigzag design. "This is Cassiopeia."

Stiles raises his head as he listens to Theo, a disbelieving chuckle leaving his mouth. "Are you serious?"

Instead of deigning the question with a reply, Theo transfers the press of his fingers upward of Stiles's right shoulder blade. "Dubhe, Merak, Phecda-'' Stiles grunts, twisting his head to look at Theo, catching only the last of the names. "Mizar, and Alkaid at the tail."

Stiles lifts a brow, "You really can?"

"Ursa Major. There's another one."

Stiles looks astonished now, but he waves for Theo to continue.

Theo lowers the pad of his fingers, a little below the right shoulder blade. "Pherkad, Kochab-" Theo dips his body as he continues naming the stars, readjusting his position until he is low enough to drop a kiss on the pale skin and the one mark he gazes in reverie. His hands transfer to the sides, caressing the curve of Stiles's hips. He hears Stiles falter when Theo's breath fans his naked skin. "And here at the tip of the Ursa Minor," Theo whispers, "is the star that is a beacon to every sailor."

A small gasp comes out of Stiles when the soft lips of Theo's mouth connect to his skin.

"There's a map of the stars in one of the books I acquired for you," Theo says, climbing up Stiles's body and kicking the sheets off down the bed, unnecessary, combining the heat of his body with Stiles's once again. He takes one lobe to his mouth, suckling softly. "You can see for yourself."

Stiles whimpers as he arches his body to the hard planes of Theo's behind him. A knee nudges his thighs, and they part with no hesitation. Theo's manhood is hot and heavy on his hip, and there's no way he would get off the bed to look at illustrations of celestial bodies that he hardly cares about, "Later,"

The stars can wait. Theo's in the harbor now, and therefore, he is Stiles's until they take him away again.

•••

After they catch their breaths much later, Stiles covers himself as he sits and flips the pages of the books that Theo promised to him. Theo sits contentedly to the side, watching him.

"Why are you angry with me?"

The question catches him off guard, but Stiles doesn't deny it. Theo is leaving in the morning, and Stiles has months to berate himself for his embarrassing honesty. "You said you would be back in two months when you left the last time," Stiles begins, refusing to get tongue-tied for the millionth time. "You were gone for five."

Theo sighs, ducking his head as if he already expects the answer. When he raises his head again, his eyes are soft with an apology. "The sea is unpredictable. Some journeys are longer than others."

"And some ports," Stiles adds moments later, swallowing the emerging lump in his throat. "Will soon be irrelevant visits - a distant memory for a man who trades across big and bigger seas."

They hold each other's gazes for a long while, concluding with a small smile, contrasting the slight tremble of Theo's eyes.

"Maybe."

•••

In the morning, before they lift the anchor and hoist the sail of their vessel, Theo kisses him and says, "I do not make promises. But you have the North Star on your back, and I always follow it."

Stiles knows it is a promise, nonetheless.

~•~

#steo#steo fic#steo au#teen wolf#stiles stilinski#theo raeken#stiles x theo#sailor au#late to the party woes#fics tag#well i was listening to this song#and the rest is history

50 notes

·

View notes

Text

Understanding the Cup and Handle Pattern in Stock Market Trading

In the world of technical analysis, chart patterns play a significant role in helping traders predict future price movements. Among these, the cup and handle pattern is a well-known bullish continuation pattern that suggests the potential for an upward trend in a stock's price. This blog will explore what the cup and handle pattern is, how to identify it, and how traders can effectively use it in their trading strategies.

What is the Cup and Handle Pattern?

The cup and handle pattern is a chart formation that resembles the shape of a tea cup. It consists of two parts:

The Cup: This is the larger, rounded part of the pattern that looks like a "U" or a bowl. It forms after a stock's price declines and then gradually recovers, creating a rounded bottom.

The Handle: The handle appears after the cup is formed, usually as a short period of consolidation or slight downward movement. It typically forms on the right side of the cup and is followed by a breakout to the upside.

The pattern generally signals that the stock is likely to continue its previous uptrend after the consolidation phase represented by the handle.

Key Features of the Cup and Handle Pattern

To identify the cup and handle pattern effectively, it's important to understand its key features:

Shape and Depth of the Cup: The cup should have a rounded, "U" shape, indicating a gradual recovery in the stock's price. A V-shaped cup is less ideal as it suggests a more volatile movement. The depth of the cup should be around one-third to two-thirds of the previous price rise.

The Handle: After the cup forms, the handle usually slopes slightly downward or moves sideways. It represents a period of consolidation where the stock may face temporary resistance. The handle should not be too deep; ideally, it should retrace no more than one-third of the cup's depth.

Volume Patterns: Volume typically decreases as the cup forms and the price bottoms out. During the formation of the handle, volume may also decrease. A significant increase in volume often accompanies the breakout from the handle, confirming the pattern.

How to Trade the Cup and Handle Pattern

Trading the cup and handle pattern involves several steps:

Entry Point: Traders usually enter a position when the stock price breaks above the resistance level formed by the handle. This breakout is a strong signal that the stock is likely to continue its upward movement.

Stop-Loss Placement: To protect against potential losses, place a stop-loss order below the lowest point of the handle. This helps manage risk in case the breakout turns out to be false.

Profit Target: A common method to set a profit target is to measure the distance from the bottom of the cup to the breakout point and project that distance upwards from the breakout point. This gives an estimate of the potential price move.

Example of the Cup and Handle Pattern

Imagine a stock that has been in a strong uptrend. The price then declines over several weeks, forming a rounded bottom (the cup). After recovering to a level near the previous high, the stock trades sideways or slightly downward, creating the handle. Volume decreases during the handle formation, but as the price breaks out above the handle's resistance level, volume spikes, confirming the pattern.

A trader enters a long position at the breakout, sets a stop-loss below the handle, and targets a profit based on the cup's height. The stock continues to rise, reaching the trader's profit target.

Conclusion

The cup and handle pattern is a powerful tool for traders seeking to identify bullish continuation patterns in the stock market. By understanding its structure and how to trade it effectively, traders can improve their chances of capturing profitable opportunities. As with any trading strategy, it is important to combine this pattern with other technical indicators and sound risk management practices to enhance overall success.

0 notes

Text

How does swing trading operate and what is it?

If you are interested in stock trading and have begun your research, you may also want to become familiar with swing trading. Swing trading is a well-liked trading strategy where traders base their trade selections on technical analysis. The goal is to choose an unusual path to obtain respectable returns. Multi-day chart patterns are typically sought after by swing traders. Moving average crossovers, triangles, flags, head and shoulders patterns, and cup-and-handle patterns are some popular patterns. Cycle Scanner Framework provides detailed information for forecasting and trading. In this post, you can see about swing trading and how it works:

Identifying tradable stocks

A swing trader would first choose a stock or investment with price charts exhibiting upward and downward trends. A stock tracker can be used to accomplish this. This can aid market watchers in further identifying actively traded stocks with a certain pattern of price movement. Learning cycles decoding the hidden rhythm will help you to identify the profitable stocks easily.

Choosing a price chart

Swing traders typically use price charts that are comparatively shorter in time, from a few weeks to a few months. The time frame chosen is based on the point in the security's price movement pattern that is most obvious. You can easily predict the price chart if you have excellent cycles analysis knowledge.

Technical analysis

Trading professionals mostly employ technical analysis techniques to analyze various price movements. The principle underlying technical analysis is finding profitable possibilities to provide buy-and-sell signals. The market cycle indicator is composite indices that combine leading, lagging, and coincident variables. They are used to examine and forecast economic trends and turning points.

Wrapping it up

Thus, the above details are about swing trading and how it works. Each swing trader eventually develops a technique and plan that offers them an advantage over numerous deals. A strong trading strategy can be created using key reversal candlesticks in addition to other indicators.

0 notes

Photo

What is a Cup and Handle Pattern? | Inveslo A cup and handle price pattern on a security's price chart is a technical indicator that resembles a cup with a handle, where the cup is in the shape of a "u" and the handle has a slight downward drift📉 The cup and handle are considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. The pattern's formation may be as short as seven weeks or as long as 65 weeks📈📉 A cup and handle is considered a bullish signal extending an uptrend, and it is used to spot opportunities to go long. Technical traders using this indicator should place a stop-buy order slightly above the upper trendline of the handle part of the pattern. The pattern was first described by William J. O'Neil in his 1988 classic book on technical analysis, How to Make Money in Stocks. So, we recommend you try this trading trick and let us know your feedback in the comment section for sure. We always read what our followers express📊

0 notes

Text

chart patterns cheat sheet work VCQ&

💾 ►►► DOWNLOAD FILE 🔥🔥🔥🔥🔥 Feb 19, - Explore Wayne lai's board "TA cheat sheets (patterns)", See more ideas about trading charts, stock chart patterns, candlestick patterns. Find a broker you can trust. CHEAT SHEET. Spot trading opportunities in good times and bad with 20 classical chart patterns. REVERSAL PATTERNS. Triple Bottom. Triple Top. Cup & Handle CONTINUATION PATTERNS. Chart Patterns Cheat Sheet. Chart Patterns Cheat Sheet Ultimate Guide. Chart pattern puts stock market buying and trading into perspective. It plays an important role when it comes to. 9 When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures. Log in. Sign up. TA cheat sheets patterns. Collection by Wayne lai. Similar ideas popular now. Chart Patterns Trading. Stock Chart Patterns. Trading Charts. Stock Charts. Stock Options Trading. Options Trading Strategies. Forex Trading Strategies. Forex Strategy. Trading Quotes. Candlestick Patterns Cheat Sheet. Candlestick Chart. Trend Trading. Intraday Trading. Swing Trading. Chart School. Technical Trading. Forex Trading Quotes. Analyse Technique. Technical Analysis Charts. Online Trading. Forex Trading Training. Trade Books. Science Activities For Kids. Day Trader. Bitcoin Price. Chandeliers Japonais. Planning Excel. Trade Finance. Finance Business. Bollinger Bands. Forex Trading Basics. Learn Forex Trading. Day Trading. Money Trading. Forex Trading Software. Option Trading. Stock Trading. How to draw supply and demand levels More. Exit Strategy. ForexUseful - There are many Forex Chart patterns but its impossible to know or want to know and trade all of them, here are the Top 10 you should know…. Forex Useful. Technical Analysis Tools. Wave Theory. Stock Trading Strategies. Forex Candlestick Patterns. Forex Trading Tips. In real market, imperfect chart patterns form called …. Forex Trading System. Carpet Spot Remover. Forex Books. Candlestick Patterns. Types of trends.. Candle Stick Patterns. Forex Trading Strategies Videos. Free Charts. Image result for candlestick patterns cheat sheet. Moving in Options.. Candle Pattern. Rising Market vs. Falling Market - a cheat sheet for you on forex triangles. Chaiyapol Suriya C. Chaiyapol Suriya.

1 note

·

View note